Connecting state and local government leaders

COMMENTARY | States that used COVID relief for one-time and short-term expenses and carefully managed the funding will be well positioned when federal funding expires.

After COVID-19 descended on the U.S. and forced a partial shutdown of the world’s biggest economy in early 2020, Congress approved $5 trillion in emergency relief to respond quickly to the unprecedented disruption. The intervention worked. Though the two-month COVID recession was deeper than even the Great Recession of 2007-09, the U.S. bounced back much more quickly.

A key piece of the pandemic aid came in 2021, when Congress provided $350 billion in Coronavirus State and Local Fiscal Recovery Funds, or SLFRF, to support the budgets of states, cities, counties and tribal governments that had been forced to mount massive relief efforts while simultaneously seeing their tax revenues plummet due to lockdowns and layoffs. Included in the American Rescue Plan, SLFRF was intended to address health and economic impacts, as well as maintain critical public services during the pandemic.

The funding kept state governments afloat and helped prevent the recession from dragging on for years. But now, with SLFRF funds set to expire by the end of 2026, states face a new challenge. As detailed in a new issue paper from the Volcker Alliance authored by Beverly Bunch, states must confront the fiscal cliffs they could face if they allocated the recovery aid to recurring programs rather than one-time costs stemming from the pandemic.

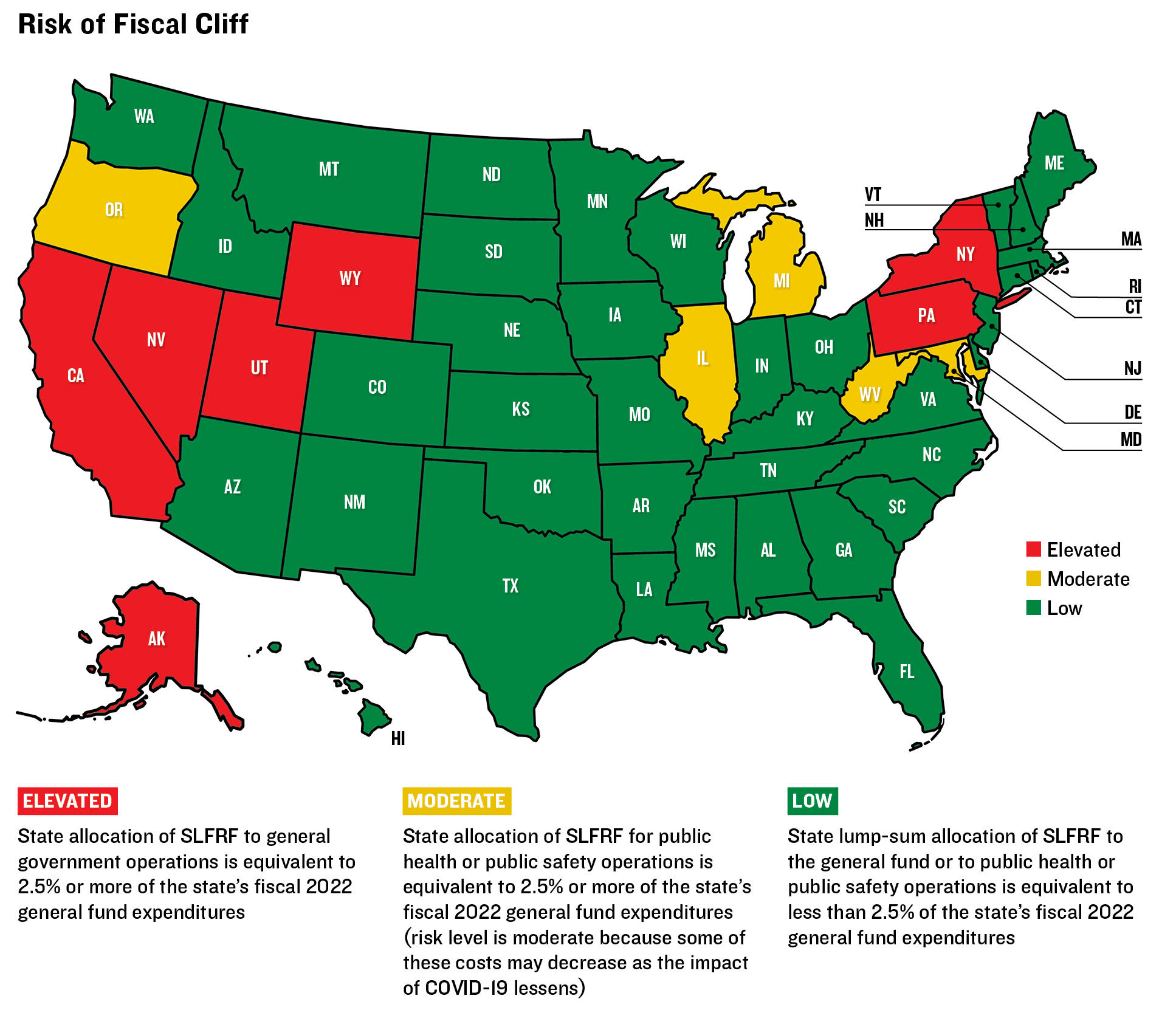

As of June 2022, 74% of SLFRF had been allocated. The good news is that 38 states primarily used this money for one-time or short-term purposes, such as capital projects, repaying federal loans to their depleted unemployment trust funds and providing short-term assistance to businesses and households. But 12 states, including California, Illinois, Michigan, New York and Pennsylvania, used SLFRF to cover recurring costs that were equivalent to a significant 2.5% or more of their fiscal 2022 general fund expenditures. These 12 states, which are home to about 40% of America’s population and total state general fund spending, thus face a moderate to elevated risk of encountering fiscal cliffs if they don’t find money to replace the federal dollars used to shore up their budgets before SLFRF expires.

Map courtesy of the Volcker Alliance.

So what can states do now to prevent falling over the fiscal cliff?

States that have not allocated all their federal funds should limit the future allocations to one-time or short-term purposes. Some states also might have the flexibility to decrease some of their past allocations to government operations. For example, in 2023, Illinois decreased its SLFRF allocation for government operations and increased its allocation to the repayment of federal unemployment insurance trust fund loans.

If a state has allocated one-time funds to address recurring needs, it should track that spending and plan for what will happen when the funding expires. Multiyear revenue and expenditure forecasts can help determine whether there will be sufficient revenues to cover that spending. States with strong, sustainable revenue growth may have enough money to continue the programs funded with SLFRF. States whose use of SLFRF for operations freed up some of their own recurring revenues (that they then used for one-time purposes, such as debt repayment or shoring up the rainy day fund) may be able to redirect those revenues to cover programs temporarily funded with SLFRF. If alternative funding sources are not available, states should plan to scale back operations.

Meanwhile, states that were careful stewards of SLFRF offer best practices to prevent budgetary shortfalls and strengthen long-term fiscal health after the federal cash runs out.

States should clearly label SLFRF as one-time funds. They can create a separate column for nonrecurring revenues and appropriations in the state budget financial outlook statement or keep a list of ongoing versus one-time revenues in budget forecast documents that also identify spending financed from one-time sources in appropriation bills. Another option is enacting separate appropriations bills to keep the allocation of one-time funds separate from general purposes, as Texas did with SLFRF.

One-time funds should be used for one-time purposes. States should enact policies that explicitly address the need to consider future fiscal sustainability when allocating one-time funds like SLFRF. Notably, Michigan included a fiscal sustainability requirement in its list of standards for evaluating potential programs to be paid for with SLFRF.

Other state budgeting practices should facilitate a multiyear planning approach. States should develop long-term revenue and expenditure forecasts, which could address the loss of

federal funds. Along with conducting stress tests to gauge budget performance and maintaining sufficient rainy day funds and other reserves, this strategy will help officials recognize the risk of a fiscal cliff and give them time to avoid it.

While the size of SLFRF was unprecedented, Congress already provided almost $700 billion a year to states before the COVID emergency. While flow of federal dollars may not return to pandemic levels for some time, states should learn from the experience of SLFRF and avoid future fiscal cliffs by putting any one-time federal funds toward one-time expenditures, rather than funding programs that address recurring needs.

Beverly S. Bunch is a professor in the School of Public Management and Policy at the University of Illinois Springfield, with a joint appointment in the Center for State Policy and Leadership. Her main research interests are state and local government budgeting and financial management. William Glasgall is Senior Director, Public Finance, at the Volcker Alliance, a nonpartisan, nonprofit organization in New York. He is also a Fellow at the Penn Institute for Urban Research and a member of Route Fifty’s Advisory Board.

NEXT STORY: Study: Rural communities still at disadvantage when competing for federal grants